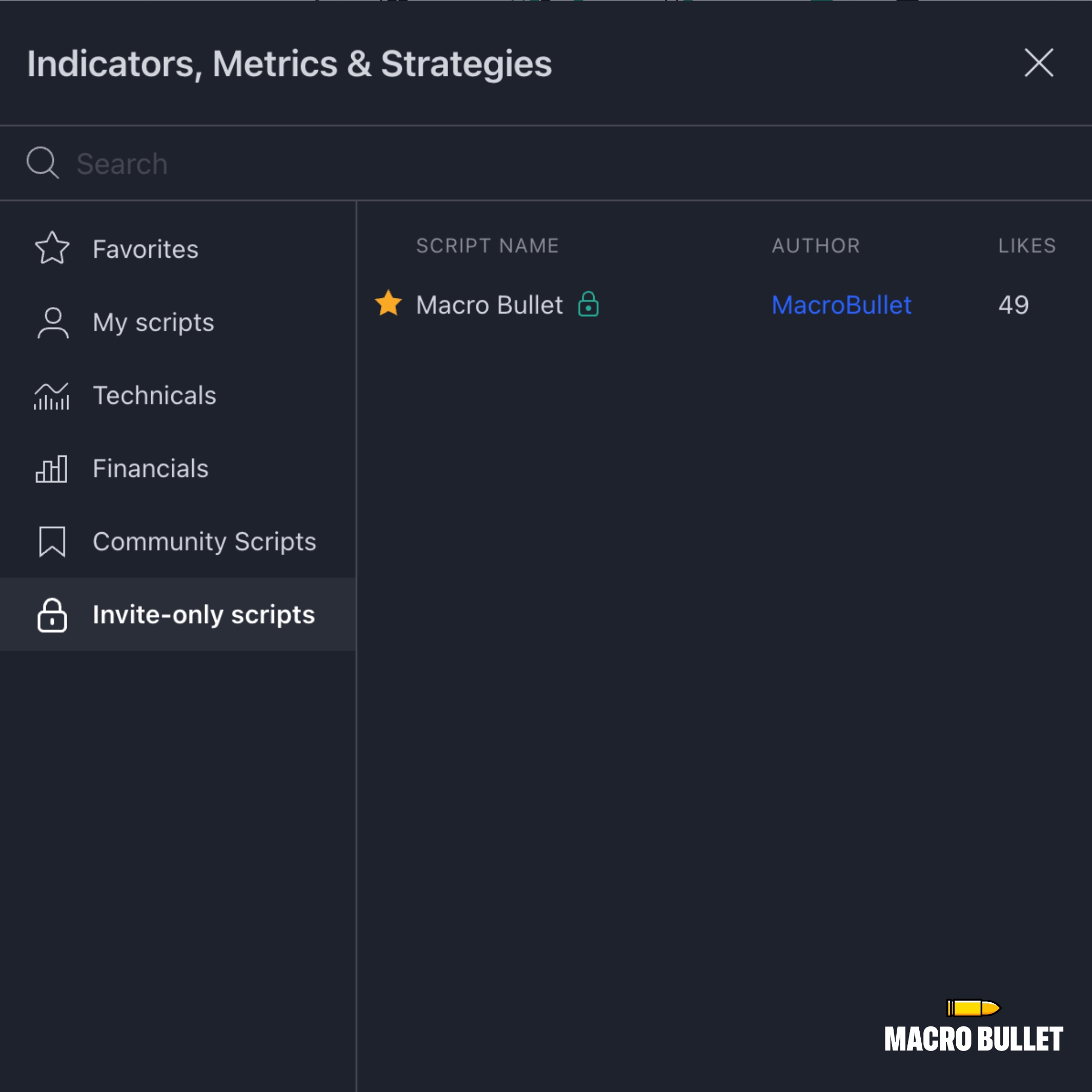

To add the Macro Bullet indicator to TradingView, make sure you requested an invite to the Macro Bullet through this link here: Macro Bullet - Request Access

Once confirmed, follow the steps below:

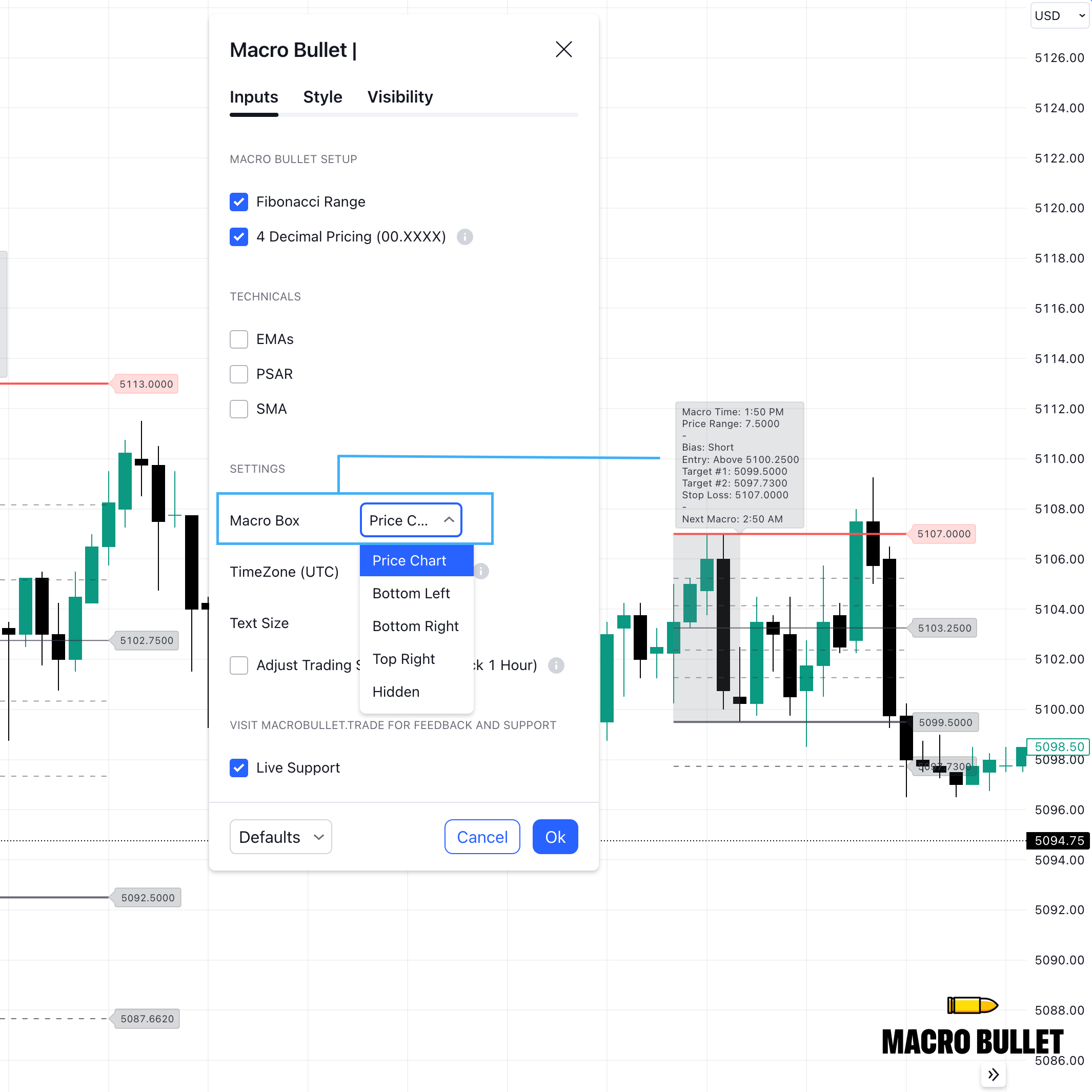

By default, all Macro Bullet time ranges are based on EST (UTC-5). Updating the Timezone (UTC) in the indicator settings, will apply the correct time of when the Macro Bullet time range will appear during your local time / region.

To adjust the timezone setting,

Note

You may need to toggle on/off the Adjust Trading Session (Shift Back 1 Hour) if the Macro Bullet time range is appearing 1 hour before/after the specific time mentioned in the Macro Bullet box.

The Macro Box, displays the Macro Bullet's suggested bias, entry target prices and stop losses. It can be placed in various locations on the chart, including the Bottom Right, Bottom Left, Top Right, or directly on the Price Chart.

To adjust the Macro Box location setting,

TradingView does not automatically sync time-based indicators on their trading charts. Specific settings for the Macro Bullet must be adjusted manually.

Macro Bullet Default Settings

Exchange: Futures

Timezone (UTC): -04

Shift Hour Setting: -01 Hour Backwards

Note

If you are trading ASX, FSE, LSE or NYSE please adjust your indicator settings.

Macro Bullet Indicator Settings

Exchange: Futures

Timezone (UTC): -04

- (Set to your chart's timezone)

Shift Hour Setting: -01 Hour Backwards

Macro Bullet Indicator Settings

Exchange: NYSE

Timezone (UTC): -04

- (Set to your chart's timezone)

Shift Hour Setting: 00 No Shift

Macro Bullet Indicator Settings

Exchange: ASX

Timezone (UTC): +11

- (Set to your chart's timezone)

Shift Hour Setting: 00 No Shift

Macro Bullet Indicator Settings

Exchange: FSE

Timezone (UTC): +01

- (Set to your chart's timezone)

Shift Hour Setting: 00 No Shift

Macro Bullet Indicator Settings

Exchange: LSE

Timezone (UTC): +00

- (Set to your chart's timezone)

Shift Hour Setting: 00 No Shift

Macro Bullet Indicator Settings

Exchange: CFD

Timezone (UTC): +00

- (Set to your chart's timezone)

Shift Hour Setting: 00 No Shift

Macro Bullet Indicator Settings

Exchange: Crypto

Timezone (UTC): -04

- (Set to your chart's timezone)

Shift Hour Setting: 00 No Shift

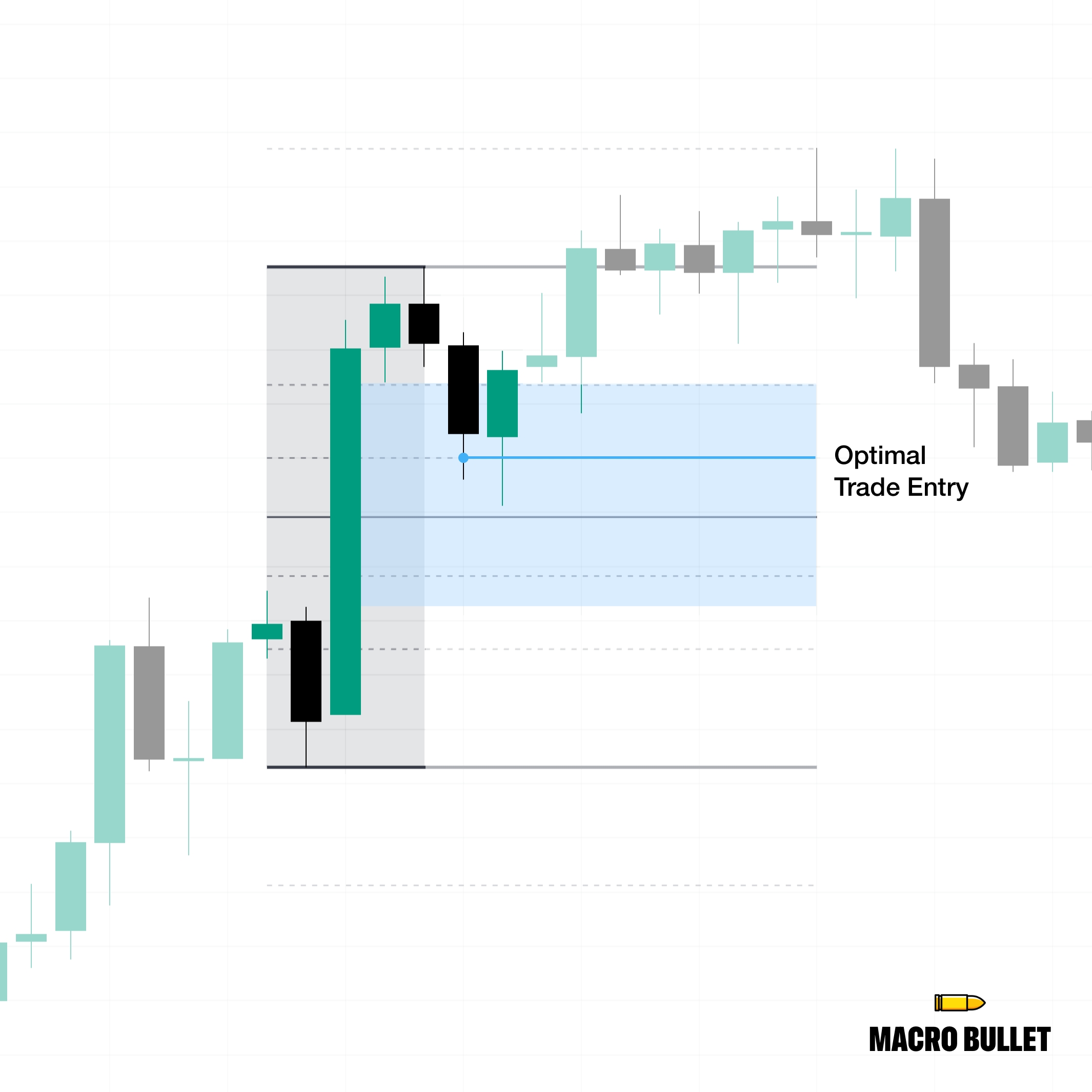

A high-probability trade entry that can appear during the Macro Bullet's time range.

What is a Fair Value Gap?

Fair Value Gaps (FVGs) is a concept termed by ICT. One way to identify a FVG, is by a consecutive 3-candle pattern where the body of the middle candle, is in between the wicks of the first and third candle.

When should I enter the position?

Typically, when the price retraces back into the FVG, look for an Optimal Trade Entry (OTE) at the 50% level of the second body's candle.

Macro Bullet Notes:

Fair Value Gaps can appear during the Macro Bullet's time range. In this case, it is okay to enter a position before the Macro Bullet's time range is complete.

Where should I place my stop loss?

Stop losses should be placed in specific places:

-FVG: The SL should be placed at the highest price (top of the wick) of the 3rd Candle.

+FVG: The SL should be placed at the lowest price (bottom of the wick) of the 1st Candle.

Where can I learn more about FVGs?

Check out ICT's (Inner Circle Trader) Twitter and YouTube pages.

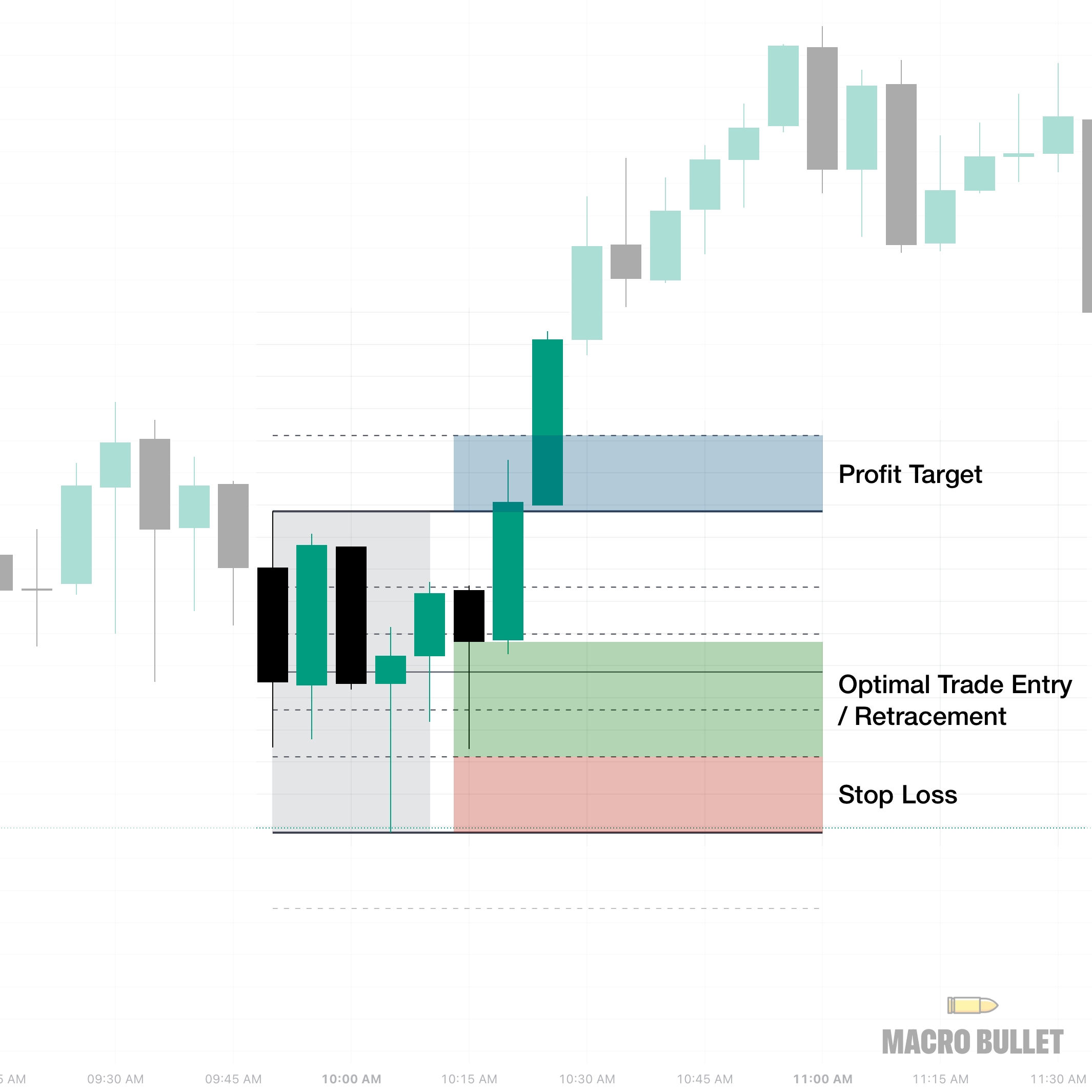

The ideal entries for the Macro Bullet is usually at retracements after the open of the 10:15 AM EST candle. Retracements back to a Fib Level, the 50% of the Macro Bullet's price range or at a discounted level are ideal.

When should I enter the position?

A retracement after the Macro Bullet's time range, 10:15 AM EST. Ideally at the 50% Fib level, or at a discounted Fib level.

Macro Bullet Notes:

Just remember, not all entries are good entries. Similarly, not everyday will provide a winning trade. We suggest to wait for a retracement where you are comfortable to enter. Move the trailing stop to at least break even to protect your downside once profitable. Don't force the trade to happen.