In the evolving landscape of financial markets, we as traders are constantly on the lookout for strategies that can give us an edge. One such approach that has garnered attention is the ICT Silver Bullet, a trading model designed by the Inner Circle Trader (ICT) to identify a high-probability trade opportunity.

This blog post will go over the core principles of the ICT Silver Bullet into an easily digestible format, offering insights into how traders can implement this strategy to enhance their trading outcomes.

The ICT Silver Bullet is not just a trading strategy but a framework that leverages specific market behaviors, liquidity patterns, and time-based setups to pinpoint potential trades with a high likelihood of success. Here’s a simplified overview of its key components:

1. Time-Based Model

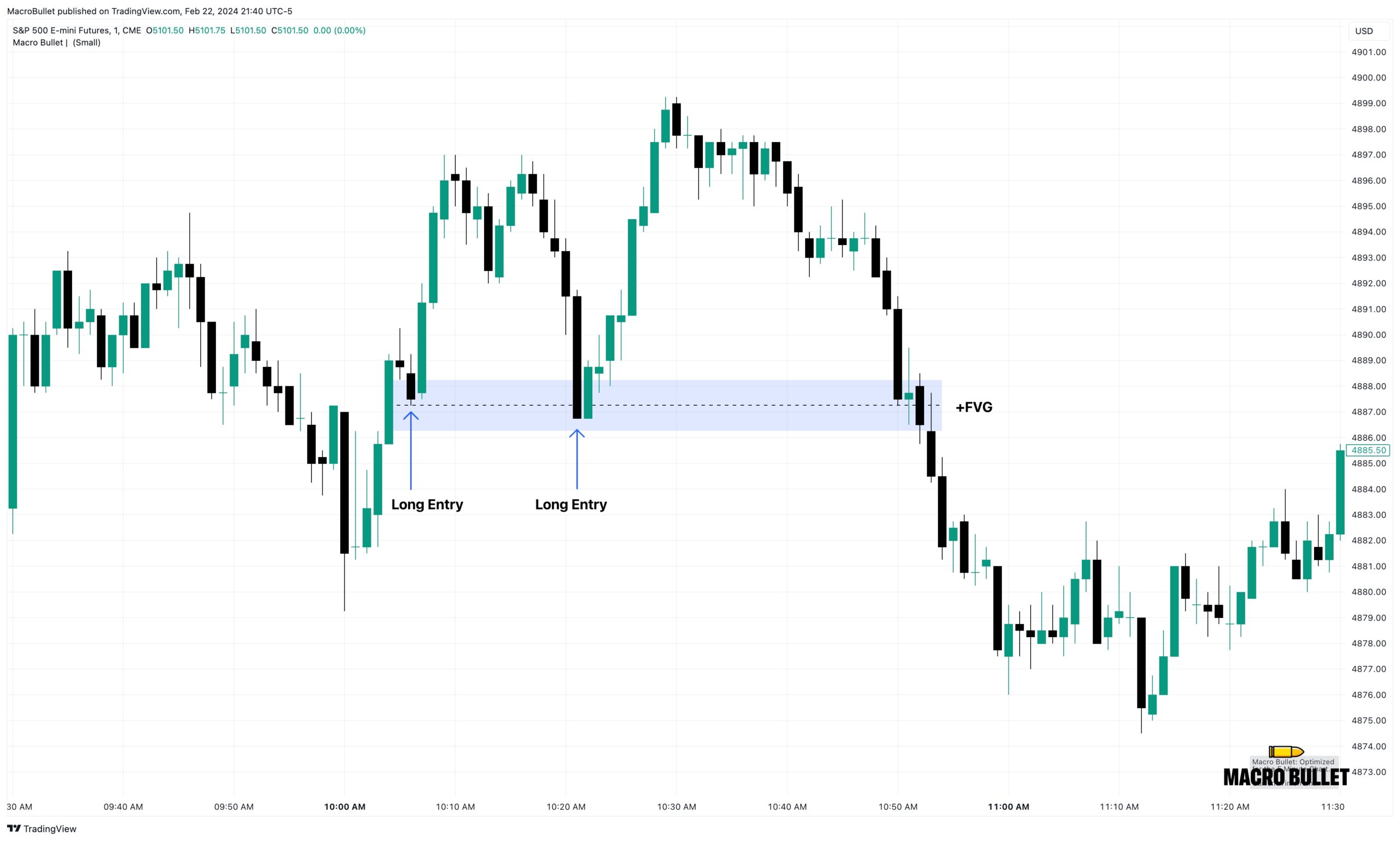

At the heart of the Silver Bullet methodology is the recognition that financial markets exhibit certain patterns or behaviors at specific times during the trading day. By focusing on these distinct time intervals, traders can significantly increase their chances of spotting high-probability setups.

These periods are chosen based on historical market activity and liquidity patterns, offering unique opportunities for traders to act on.

2. Minimum Trade Framework

To ensure a trade is worth the risk, the ICT Silver Bullet methodology outlines minimum movement expectations for different markets (e.g., 10 points or 40 ticks for index futures, 15 pips for Forex pairs). These benchmarks serve as a best-case scenario guide, helping traders assess the potential profitability of a trade without the need for perfect entry and exit precision.

3. High-Probability Setups

The ICT Silver Bullet method highlights several specific setups that indicate a high probability of a successful trade, including:

Implementing these setups involves a keen analysis of market structure, liquidity considerations, and the use of technical tools to identify and confirm trade opportunities.

4. Trade Within the Framework

A key principle of the ICT Silver Bullet is the flexibility it offers in trade execution. Traders are encouraged to execute trades within the identified framework, focusing on capturing movements within the best-case scenario range rather than striving for perfect precision. This pragmatic approach allows traders to take advantage of the overall expected move, optimizing the risk-reward ratio.

Simplifying Success in Trading

The ICT Silver Bullet methodology presents a structured yet flexible approach to trading, emphasizing time-based patterns, strategic planning, and the identification of high-probability setups. By focusing on specific time windows, adhering to the minimum trade framework, and executing trades within the outlined setups, traders can enhance their ability to spot and capitalize on lucrative market opportunities.

Whether you’re a seasoned trader or just starting out, incorporating the ICT Silver Bullet principles into your trading strategy can provide a clearer path to success, helping you navigate the complexities of the financial markets with greater confidence and efficiency.