Identifying high-probability opportunities is crucial for success. One such method is through the observation of Fair Value Gaps, a technical pattern that signals potential price movements.

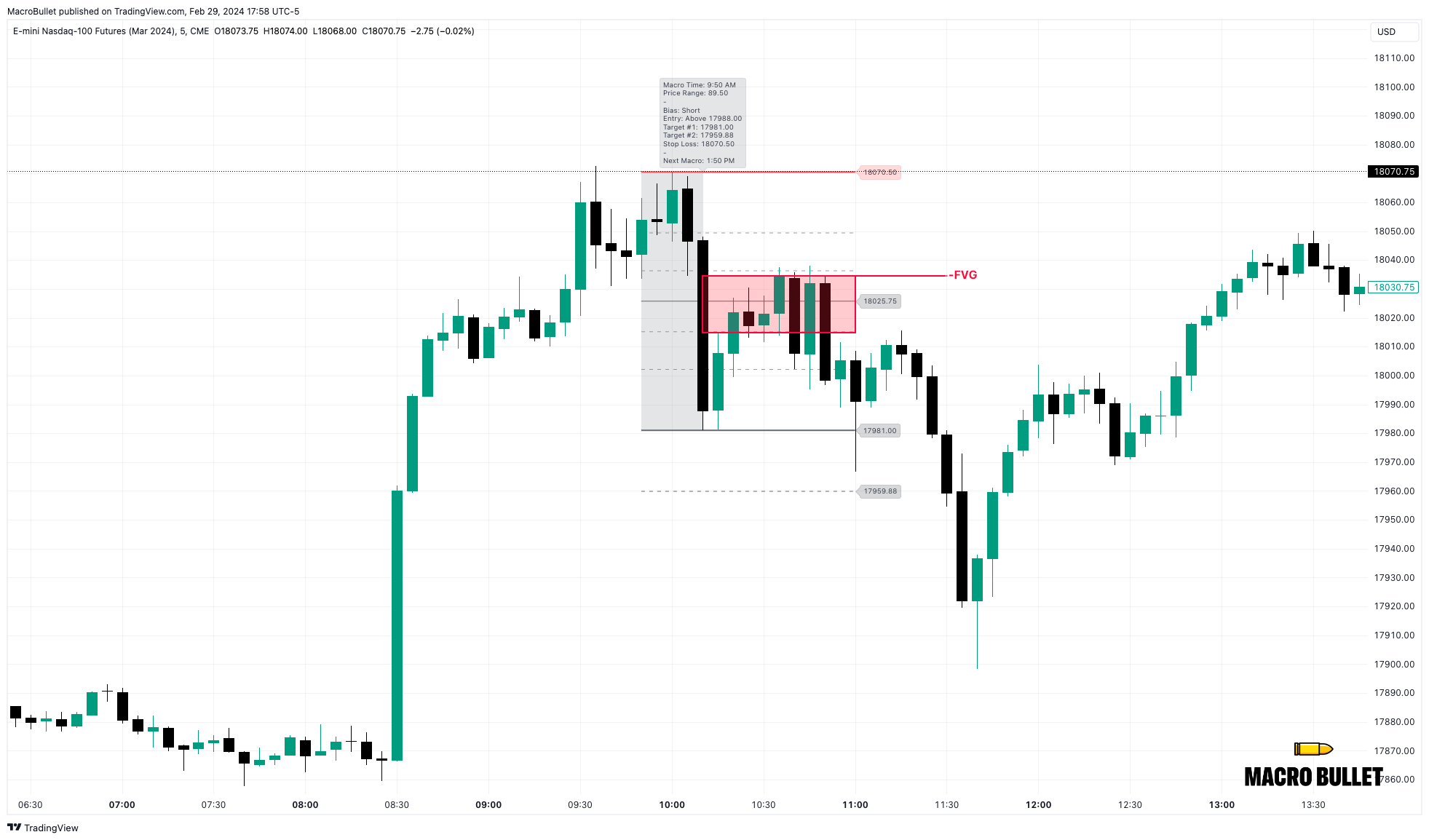

A Fair Value Gap occurs in a three-candlestick pattern where the low of the first candle and the high of the third candle do not overlap, or vice versa.

Understanding SIBIs and BISIs

To leverage Fair Value Gaps, understanding Sell-Side Imbalance/Buy-Side Inefficiency (SIBI) and Buy-Side Imbalance/Sell-Side Inefficiency (BISI) is essential.

- SIBI: Indicates a bearish Fair Value Gap, where the sell side was offered but the buy side was not. This suggests potential for a downward movement.

- BISI: Indicates a bullish Fair Value Gap, where the buy side was offered but the sell side was not. This suggests potential for an upward movement.

Trading Opportunities with Fair Value Gaps

- Identification: The first step is to identify a Fair Value Gap. This gap indicates an area where the market has not established a fair value, suggesting a price imbalance that could lead to significant moves.

- Interacting with the Gap:

- Observe how price action interacts with the Fair Value Gap upon its return.

- High-probability trades are signaled when the price reaches into the Fair Value Gap and closes out, continuing in the direction indicated by the type of gap (SIBI or BISI).

- Consequent Encroachment:

- Pay attention to the consequent encroachment of the Fair Value Gap. A high-probability opportunity is indicated when a candle closes outside of it, respecting the boundaries established by the Fair Value Gap.

- Invalidation of a Fair Value Gap:

- Knowing when a Fair Value Gap is invalidated is crucial. This happens when the price does not respect the gap, such as closing over the consequent encroachment. This suggests a shift in market sentiment and can indicate a new opportunity in the opposite direction.

- Fair Value Gap Inversion:

- A Fair Value Gap inversion occurs when a failed gap is used as support or resistance in future price action. If price returns to an old Fair Value Gap and uses it as support (SIBI) or resistance (BISI), it presents a high-probability trade opportunity.

Identifying high-probability trade opportunities involves careful observation of Fair Value Gaps, including their type (SIBI or BISI), interaction with the gap, consequent encroachment, invalidation signals, and the concept of inversion. By mastering these concepts, traders can significantly enhance their trading strategy and potential for success.